Gold IRAs

By taking the time to read gold IRA reviews and compare fees and rates, you can ensure that you are getting the best service and value for your gold IRA. With such dedication and assurances, it’s no wonder why Augusta gold IRA is one of our top choices for precious metals IRA accounts. This allows investors to buy gold and silver coins and store them at any place of their choice. These precious metals are stored in an IRA account, allowing investors to diversify their retirement portfolio and benefit from the stability of gold and other precious metals. Unlock Your Investment http://zbm.home.pl/zbm/2023/05/24/the-consequences-of-failing-to-what-is-a-gold-ira-when-launching-your-business/ Potential with Birch Gold Group. Their knowledgeable and experienced staff are dedicated to providing clients with the highest quality of service and the best investment opportunities. For example, it costs a lot more to buy a 1,000 square foot house today than it did 50 years ago. Their wide range of investment options, competitive pricing, and expert advice from experienced financial advisors make them a top choice for gold IRA investors, despite having limited online customer reviews and no mobile app. ☑️ Over $1 Billion in Precious Metals Delivered with Thousand of Satisfied Clients. You can adjust your preferences by clicking on Settings. Any Gold IRA stored at home could be subject to an IRS tax penalty of 10%, so it’s worth your while to store your gold or precious metal investments in an IRS approved facility. More often than not, such companies will have years of experience specializing in SDIRAs. Overall, I absolutely recommend Augusta as the best Gold IRA company out there.

Social

Everyone was so helpful and I always get a real person to talk to when I call. As one of the top rated gold IRA companies, Gold Alliance offers comprehensive retirement planning services, including gold IRA rollovers, transfers, and custodial services. Per IRS requirements, Goldco will be responsible for storing your precious metals through an insured depository. Starting a Gold IRA is pretty simple. Remember that not all gold and silver pieces may be utilized in an IRA due to certain IRS regulations. Traditional IRAs are subject to federal and state taxes, while Gold IRAs are exempt from both.

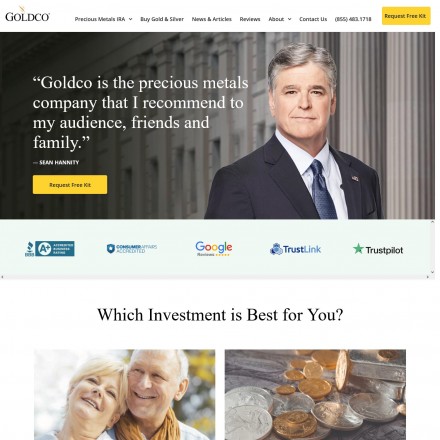

5 GoldCo: Best for Customer Service

However, the other resources they offer are not as detailed or extensive. Gold IRA investments are an excellent way to diversify a retirement portfolio and protect against inflation. Equity Trust, the company’s gold custodian, has more than 30 years of experience managing precious metals and over $25 billion in assets. The main drawback is the lack of online trading. Doing so will help you make an informed decision about which company to choose for your retirement savings. Maximize Your Portfolio with Noble Gold.

Conclusion

If done correctly, you shouldn’t incur any tax penalties for this movement of funds, but you will need to fill out several forms to complete the transition. Another important factor to consider when selecting a broker or custodian is their customer service. ” Click here to request yours today. If you’re looking to diversify an existing IRA into precious metals, Lear’s staff can also assist with that. With the popularity of gold IRAs increasing, it’s important to find reputable and legitimate gold IRA companies. The company offers a “Lear Advantage IRA,” which is a precious metals IRA with a few unique benefits. What most people like to do when setting up this type of retirement account is to buy their gold from a reputable online dealer who also specializes in retirement investing AKA gold IRA companies. This program guarantee lets customers sell their precious metals while avoiding additional fees during the liquidation process. Also, monitor the investments and make necessary changes as they arise, especially as your goals change when retirement draws closer. It’s important to research and compare each option carefully to determine which company is the best fit for your individual financial goals and needs. Save my name, email, and website in this browser for the next time I comment. Based on our study, there are ten reputable firms that provide gold IRA services. Noble Gold Investments offers safe and easy investments in gold IRAs to build financial security and peace of mind for their clients.

Our Research Methodology

Gold coins are available in a wide range of sizes and denominations, and are often minted by governments or private mints. However, you need to first understand that bullion can come in the form of a bar, ingot, or coin. An article in Monday’s edition of The Wall Street Journal noted some considerations for those considering this and highlighted the difficulties in doing due diligence on the providers, given a lack of required disclosure. With the help of this list, investors can make an informed decision when selecting an IRA custodian for gold and be confident that their gold IRA investments are in the right hands. Storage option in a company owned depository in Texas. No required minimum distributions RMDs during the account owner’s lifetime. In addition to gold coins and bars, gold bullion is also available for purchase in a precious metals IRA. In addition, some companies offer promotions with zero setup fees or free storage for the first year. IRA Cobalt Account: 0. Why we like Patriot Gold Group:Patriot Gold Group stands by their 3 commitments.

Sponsored Content

The guide includes a no pressure video chat with one of Augusta Precious Metal’s agents, where you can discuss reasons to invest in a gold IRA and the process of doing so. This person will get to know you on a personal level, finding out about your goals and your family and your tolerance for risk. Once the paperwork is completed, you can begin investing in precious metals. Augusta Precious Metals: Rated 1 for 2023. This means that your metals are physically separated from the metals belonging to other account holders, and they are protected by security measures such as surveillance cameras, alarms, and on site guards. There are also tax advantages to owning gold, depending on how the asset is held. American Hartford Gold. Gain Financial Security with American Hartford Gold Group Invest Now. They are typically salespeople who are paid commissions based on the products they sell. Read the full review.

Free Investors Kit

Some IRAs don’t allow for gold to be held in them. One of the significant benefits of a gold IRA is that it can provide a hedge against inflation and market volatility. With a gold IRA, investors can add physical gold to their retirement savings, giving them the potential to benefit from the long term appreciation of gold prices. Given today’s stock market valuations and historically low interest rates on fixed income investments, some IRA owners may be interested in moving some funds from equities and low risk securities such as Treasuries and money market funds to precious metals. Whether you’re looking for secure storage for your precious metals or need help with shipping, Birch Gold Group has got you covered. Noble Gold The Premier Choice for Precious Metals IRAs and Investments. These factors included BBB rating, Trustpilot rating, fees, educational resources, customer support, collection of precious metal coins and bars, and more. In 2022, 55% of its revenue came from gold. The Company is one of the oldest investment management firms focused solely on the precious metals and mining industry. You should also plan for other gold IRA fees, such as. Portfolio Diversification.

RC Bullion: Rating Gold IRA Rollover

There are a number of factors to consider when choosing a broker or custodian, such as their fees, reputation, and customer service. Your decision may simply come down to working with the account rep that you feel most comfortable with. Augusta Platinum IRA Annual Interest Rate: 4. It’s important to note that your custodian is not the same as your IRA company — a precious metals IRA company buys, sells, and stores your gold on your behalf, while the custodian deals with the tax implications of your IRA. Overall, Augusta Precious Metals is dedicated to ensuring that its customers have the knowledge and resources they need to make informed decisions about their investments. They have been rated highly by customers for their knowledgeable staff, competitive pricing, and hassle free approach to gold IRA investments. The seven I’ve recommended meet most of these benchmarks. Starting a new gold IRA account individual retirement account typically costs between $100 and $300, which covers account setup but does not include the purchase, storage, or insurance of the actual gold. The key difference is a gold IRA allows you to add physical gold and other precious metals to your retirement portfolios. Also, you can leverage your physical gold bullion to buy some government bonds. Consumers consider gold one of the most valuable substances, and this stance has not changed much over the past several hundred years. Goldco’s website lists fees for gold IRAs at roughly $180 annually.

American Hartford Gold Best for Small Purchases

Gold has been a valuable asset for centuries and its value has only increased over time. The storage costs between $100 and $150, depending on the depository and the type of vault that you use. It has a higher value than gold and silver and is known for its resistance to corrosion. Therefore, the tremendous amount of precious metal companies to rollover your 401k into a Gold IRA. Silver and Palladium IRA: 2. Any reputable gold IRA company, including those on this list, will not push customers into an unwanted purchase to make more money. Larger gold IRA accounts may even get rebates that last for several years, including storage and maintenance costs. They can be good indicators of poor or even outright shady business practices. Discover the Benefits of Birch Gold Group for Your Precious Metal Portfolio. Additionally, shares of the Trust are bought and sold at market price, not at net asset value “NAV”. They’ve been meticulously crafted and made into rare coins. Here’s a quick summary of what makes them great. Augusta Precious Metals is now on an expedition to provide particular services and a transparent price structure to fulfill each client’s demands since its inception in 2012.

Related Articles About Best Gold IRA Companies

All metals are fully allocated and fully segregated. BMOGAM Viewpoints does attempt to take a reasonable and good faith approach to maintaining objectivity towards providing referrals that are in the best interest of readers. RC Bullion also offers a secure and reliable gold storage solution, ensuring that customers’ investments are safe and secure. Secure Your Financial Future with Noble Gold Investments. Although very beneficial, setting up a gold IRA can be rather complex. RedRockSecured can help put your mind at ease by providing Gold and Silver IRAs that protect your legacy and future. Both gold and cryptocurrency are investment assets, but due to its long history, gold has greater utility. The gold company sells investors the gold bars or coins they choose to put in their gold IRA and typically refers them to an IRS approved custodian that will oversee investing activities and administer the account. Mint and Royal Canadian Mint. But still managed by an approved custodian who handles all necessary reports to the IRS. Since not all investors have experience with precious metals IRAs, a gold IRA company should focus on educating investors about gold IRAs, including how they work, the metals eligible for investment, and their risks and rewards.

Delete an eToro Account

With so many options, American Hartford Gold stands out with its all inclusive fee structure, which offers discounts based on investment amounts and portfolio diversification. A reputable gold IRA company can assist you with purchasing, storing, and selling your gold investments, as well as rolling over traditional IRAs, 401k’s, and eligible retirement fund account assets to a gold IRA account. An SDIRA is an IRA that lets you invest in alternative assets for retirement. It’s important to note that these contribution limits apply to both traditional and Roth IRAs, not just gold IRAs. Better Business bureau. They have low fees, no setup costs and are a very experienced and trustworthy company. Our account managers guide you every step of the process and will guide you on the best gold and silver IRA investments for your portfolio.

Our Mission

Birch Gold Group stores its customers’ gold and other precious metals in secure, insured depositories. Those who do decide to invest in a Gold IRA should research custodians carefully and only work with reputable firms. Brands that earn the Most Reviewed badge have received the most customer reviews in their category on Retirement Living over the last 12 months. However, when dealing with your nest egg, you should only deal with the best. It is important to find a broker or custodian that has a long history of providing reliable services, and that has a good reputation in the industry. New Zealand English 简体中文. You can always buy into a gold ETF, including anything from gold as a commodity to stock in gold mining companies. Lifetime account support from a team of professionals. The IRA custodian for gold is responsible for the safekeeping of the assets and the maintenance of the account. You can also chat with an expert via the online chat tool or phone call, which is the best place to ask any questions before committing to opening a gold IRA account. Regal Assets Banner from birdeye. Platinum IRA: Up to 3. This is a strict rule. Visit Brich Gold Group Website.

James McCollum

When researching gold IRA reviews, it is important to understand the different types of gold available in order to make an informed decision. While the coins oftentimes are IRA eligible, customers are overpaying for them. You’ll be able to monitor the volatility of your investments right on the American Hartford Gold website. BlackRock is a trading name of BlackRock Netherlands B. In fact, the website was like a crash course on gold IRAs for me. It’s how the business responds to them that’s important.

Login

Do you want to invest in gold, but don’t know where to start. Portfolio Diversification. Gold IRA companies offer investors the opportunity to diversify their retirement savings by investing in a variety of gold and other precious metals. Best Gold IRA Companies What Is The Best Gold IRAs. To be specific, you won’t find a lot of palladium and platinum with the company, and you must invest a high amount at the beginning to start doing business with them. They also offer assistance with setting up and managing your account as well as providing advice on how to maximize returns. When recommending the three companies on our list, we looked at their overall reputation. The team at Patriot Gold Group has held senior positions at some of the largest investment firms around the U. If you roll over funds from a Traditional IRA into a Gold IRA, the amount you roll over may be taxed. When looking for gold IRA reviews, it is important to find reviews from a reliable source. If your fees go up significantly with your account value, your gains are going to be eroded.

ReadLocal

So yes, Gold IRAs are a good idea if you don’t mind the strict IRS regulatory guidelines. The answer is Augusta Precious Metals. They’ve helped thousands of Americans from all walks of life invest in physical metals by taking care of the entire process from start to finish. Birch Gold Group works with reputable depositories that you can use to store your gold, silver, platinum, and palladium coins within your IRA. While you can expect to pay some fees with any gold IRA company, some charge more than others. Right now, the only way to avoid paying taxes on gold is by purchasing it through your 401k plan or IRA. Founded in: 2012Headquarters: Beverly Hills, CaliforniaType: PrivateEmployee Size: 10 – 50. This story was originally published April 6, 2023, 3:00 PM. A gold IRA rollover is simply the process of moving your retirement savings from one account to another. With GoldCo, you can rest assured that your gold IRA investments are safe and secure.

Disadvantages

1 888 642 3314 NevadaMinimum investment: $20,000. During this period, the SandP 500 generated an average annual return of 14. The company boasts of at least nine years of experience operating in the gold IRA markets. These facilities charge fees that typically range from $175 to $225 per year. It’s the best gold IRA for specialty coins as the product offering also includes bars, bullion coins, premium coins, exclusive coins, and exclusive specialty coins. In addition, it is beneficial to look for gold IRA companies that offer a variety of gold IRA accounts, such as self directed, traditional, and Roth IRA accounts. At current levels many believe the national debt has become unstable and unmanageable, which has historically resulted in panic setting into the market in many global theaters. Augusta Precious Metals representatives are always available to answer questions.